How Much is 35 an Hour Salary Annually in 2025

Discover the annual salary for $35 an hour in 2025. Learn about budgeting, lifestyle impacts, and tax implications.

- Understanding Hourly Wages

- Calculating Your Annual Salary A Step-by-Step Guide

- The Impact of Working Hours on Annual Income

- What 35 an Hour Means for Your Lifestyle Budgeting Insights

- Comparisons with the Current Salary Standards Is 35 Competitive

- Exploring Tax Implications on Your Annual Salary

- Employment Trends and Future Outlook

Understanding Hourly Wages

Let’s dive into the world of hourly wages, shall we? When we talk about hourly wages, we mean how much you earn for every hour you work. It’s that simple! So, if you’ve ever asked the question, "35 an hour is how much a year?" then you’re already on the right track to understanding this important piece of the employment puzzle.

Definition of Hourly Wages

Hourly wages are the payment you receive based on the hours you put in on a job. Think of it like chopping wood— if you swing your axe for an hour and get a certain number of logs, that’s your hourly wage. If you work longer, you earn more. It’s pretty straightforward. This way of earning is common in many jobs—from waitressing to construction work and everything in between.

Importance of Hourly Rates in Employment

Now, why do hourly rates even matter? Well, for starters, they can really shape your budget and lifestyle. Knowing how much you earn each hour helps you plan for groceries, rent, and, oh yes, your beloved evening pint at the local pub. Plus, if you’re working a job where hours can vary, your hourly rate becomes even more critical. It’s kind of your financial compass.

Overview of Factors Affecting Hourly Wages

So, what makes one folks’ hourly wage higher than another's? Here’s where it gets interesting. Several factors come into play:

-

Experience : Just like a seasoned knight at battle, the more experience you have, the more you'll likely earn. Entry-level jobs often pay less than those for veterans.

-

Location : Ah, geography! Wages can vary by city or state. A job that pays decently in a small town might not cut it in a bustling metropolis, much like how a cozy cottage might not satisfy a warrior used to a castle.

-

Industry : Some sectors just pay better than others. Healthcare and tech often top the charts, while others, like retail, might lag behind.

-

Education : Sometimes, having a degree can boost your pay, just like how being well-read in the olden days helped you gain respect in your village.

-

Demand : In some fields, if there’s high demand for workers, wages go up. Think of it like a popular gathering where everyone wants to join in!

So, if you’re pondering “35 an hour is how much a year?”—it really depends on the hours you work. If you roll in at 40 hours a week, that’s about $72,800 a year. Not bad, huh? Overall, understanding these factors can be your secret weapon in navigating your career path. Now, go forth and conquer your financial future with this knowledge in hand!

Calculating Your Annual Salary: A Step-by-Step Guide

So, you’re curious about just how much you’d rake in annually if you earn 35 an hour, huh? Let’s break it down, step by step, just like a friendly chat over a pint.

Formula to Convert Hourly Wage to Annual Salary

First up, let’s tackle the math. The formula to convert your hourly pay into an annual salary is pretty straightforward. You multiply your hourly rate by the number of hours you work each week and then by the number of weeks you work in a year. Here it is, plain and simple:

Annual Salary = Hourly Wage x Hours per Week x Weeks per Year

If you’re working full-time (like a lot of us do), that’s generally 40 hours a week and about 52 weeks each year, give or take a holiday.

Example Calculation for 35 an hour is how much a year

Alright, let’s plug the numbers into that formula. For someone making 35 an hour:

- Hourly Wage: 35

- Hours per Week: 40 (that's the typical grind)

- Weeks per Year: 52 (unless you’re off gallivanting during summer)

Doing the math:

35 x 40 x 52 = 72,800

So, if you’re clocking in at 35 an hour, you’re looking at an annual salary of about 72,800 bucks. That’s pretty decent, right?

Considerations for Full-Time vs Part-Time Work

Now, let’s chat about full-time versus part-time work. If you're grinding 40 hours a week, the earlier calculation holds true. But what if you’re part-time? Say you only work 20 hours a week. You’d calculate it like this:

35 x 20 x 52 = 36,400

That’s a world of difference!

Also, keep in mind if you’re working part-time, benefits might not be as sweet. Health insurance, retirement plans—those perks often come with full-time gigs. Do you want to make that cash while still being able to buy the best ale in town? It's something to think about.

So, whether you’re full-time hustling or part-time chilling on the side, understanding how much 35 an hour is how much a year can help you map out your financial future. And remember, keep an eye on those hours; they can really change the game. Keep your chin up and your calculator handy, and you'll do just fine!

The Impact of Working Hours on Annual Income

When we think about how much you can earn in a year, it often boils down to working hours. So, let’s dig into it! If you're curious about “35 an hour is how much a year,” you’ll find that figuring out this number isn’t rocket science.

Standard Work Hours and Their Implications

Most folks work about 40 hours a week, right? That’s your standard gig. If you clock in the typical 52 weeks a year, you can make some decent cash. For instance, at $35 an hour, if you’re working full-time, your math comes out to:

35 (hours) x 40 (weeks) x 52 (weeks) = $72,800 a year.

Not too shabby! This is the kind of dough that can help you pay the bills and enjoy a pint at the local pub. However, remember that lots of folks take vacation time or call in sick. Those hours can add up quickly, slicing into your annual income.

Overtime Pay and Its Effect on Annual Salary

Now, let’s chat about overtime. If you’ve ever pulled a double shift or worked on weekends, you probably know the overtime pay can make a big difference. Usually, employers pay 1.5 times the standard rate for any hours worked over 40 in a week. So, if you’re making $35 an hour and you work just a few extra hours each week, that really adds up.

Just imagine you work an extra 10 hours a week. That’s 10 hours x $52.50 (overtime rate) which totals $525 a week. When you factor in those extra hours for a whole year, you could easily boost your annual income to around $80,000. Money like that can buy you a pretty sweet ride or help save for your future.

The Role of Salary Negotiation in Hourly Pay

Now, let’s talk about something that doesn't get enough buzz—salary negotiation. When you’re first going for a job, don’t just accept the first number tossed your way. Doing your homework can pay off. If you believe you deserve more than $35 an hour, make your case! Talk about your skills, experience, and what you bring to the table.

I’ve learned the hard way that negotiating can feel uncomfortable, but it’s worth it. Employers usually expect to haggle a bit. And who knows? You might even jump up to $40 an hour! That could skyrocket your income to $83,200 a year. Just think how those extra coins can help you travel, save for a home, or even start a side hustle.

At the end of the day, pay attention to how many hours you’re working, keep track of overtime, and don’t shy away from negotiating your worth. Understanding how these factors impact your income can make a world of difference in your financial journey. Want to know "35 an hour is how much a year?" By understanding the broader picture, you can position yourself better in your career and life.

What 35 an Hour Means for Your Lifestyle: Budgeting Insights

When you look at the pay rate of 35 an hour, it’s easy to start daydreaming about the lifestyle that could come with it. So, let’s break down what 35 an hour is how much a year—not just numbers but what it really means for your day-to-day life!

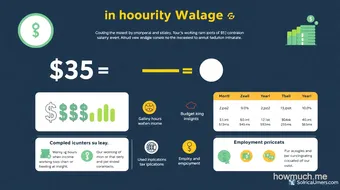

Breakdown of Monthly and Yearly Income from 35 an Hour

First off, if you clock in at 40 hours a week, you’re making about $1,400 weekly. Multiply that by about 52 weeks a year, and you’re looking at an annual income of about $73,400. Sounds pretty sweet, right? But hold up! That’s before taxes. Depending on where you live, your take-home pay could be a bit less each month.

Let’s do some quick math. If we just talk monthly, that’s roughly $6,116 before taxes. I’m no accountant, but you might see around $4,500 to $5,000 after the taxman takes his share—again, this can change based on local tax rates.

Cost of Living Adjustments Based on Location

Now, if you think 35 an hour can turn you into a modern-day lord, think again—especially if you’re living in a big city. The cost of living in places like San Francisco or New York City is sky-high. Rent can easily top $2,500 for just a one-bedroom flat! You might find yourself wondering if you're living in a castle or a shoebox... more like the latter, right?

On the other hand, if you’re in a small town or somewhere in the Midwest, that same income can stretch a lot further. You might snag a decent two-bedroom home for half that rent! Your lifestyle could vary drastically based on where you throw down roots.

How to Budget efficiently on 35 an Hour

Alright, let’s talk budgeting—this is where the rubber meets the road. If you’re making 35 an hour, you’ll want to keep a close eye on where your dollars are headed.

-

Make a List : Write down all your monthly expenses. Include rent, utilities, groceries, and that Netflix subscription you can’t live without.

-

50/30/20 Rule : This classic rule can help. Try to allocate 50% of your income to needs (like housing), 30% to wants (like that weekly takeout), and 20% to savings.

-

Emergency Fund : Build a small cushion. Aim for about three to six months’ worth of expenses. Trust me, you’ll sleep better knowing you’re prepared for surprises.

-

Track Your Spending : This might sound dull, but yes, jot down every dime. Sometimes you’ll find those little expenses sneak up on you, like that coffee that just keeps calling your name.

-

Enjoy Life but with Limits : Sure, splurge on a weekend trip now and then, but also remember your goals. A little planning goes a long way.

At the end of the day, living on 35 an hour is totally doable and can be quite nice if you work it right! Just remember to create a budget, be mindful of your choices, and have a little fun along the way. You’ve got this!

Comparisons with the Current Salary Standards: Is 35 Competitive?

When thinking about income, you might wonder how a wage of 35 an hour stacks up against other pay rates. Let’s dig into that and see what it means in our current economic climate.

Overview of Average Salaries in 2025

By 2025, the average salary has been on a steady rise. Estimates suggest that the median income is around 56,000 annually. Quite a leap, right? So, if you’re making 35 an hour, how does that translate? If you work full-time, that’s about 72,800 a year before taxes. Not too shabby! It puts you well above the average, making a solid case for 35 an hour being competitive in today's market.

How 35 an Hour Compares to Minimum Wage

Now, let’s chat about minimum wage. In many places, it hovers around 15 an hour. If we compare that to 35 an hour, it’s clear: 35 is a hefty step above the baseline. With 35 an hour, you’re earning more than double the minimum wage. That number really gives you some breathing room. It means you could save more, spend a little on treats, or even enjoy a night out without breaking the bank. Feeling like a king or queen yet?

Insights on Economic Forecasts and Job Markets

What’s the job market looking like? Well, experts say that it’s shifting towards higher-paying roles as industries evolve. Skills in tech and healthcare are in hot demand. If your pay reflects the need, 35 an hour could become even more enticing as companies compete for talent. It’s like a good ol’ Anglo-Saxon market day: supply and demand at work!

Want my two cents? Look into upskilling. The more skills you pack into your bag, the more you can potentially earn. And as companies seek skilled labor, it creates more opportunities. The future can be bright, especially if you stay on top of trends!

So, when considering if 35 an hour is competitive, remember it puts you above average and offers flexibility. Whether you’re saving or spending, you're likely in a good spot. Keep your eyes peeled for opportunities, and you could keep moving upwards on the wage ladder.

Exploring Tax Implications on Your Annual Salary

When we think about earning 35 an hour, many of us wonder, "How much is that every year?" But hold your horses! There's a lot more to it than just crunching the numbers. Let's delve into the tax side of things, and I’ll guide you through the maze of tax brackets and after-tax income.

Overview of Tax Brackets in the U.S. for 2025

First off, in 2025, the IRS has set up tax brackets that can feel like a puzzle at times. The more you earn, the higher the percentage of tax you'll pay. For example, individuals making up to $11,000 pay 10%. If you make between $11,001 and $44,725, you’ll see a 12% tax rate kicking in. Then there's 22%, then 24%, and so on. It’s like climbing a ladder—each rung gets a bigger bite of your earnings.

Now, if you’re making 35 an hour and working a full-time job, you're pulling in about $72,800 a year, assuming a 40-hour workweek. This places you neatly into that 22% bracket. But don't worry, you aren't paying 22% on everything! You only pay that on the amount over $44,725. It’s a bit like paying a toll only when you hit certain checkpoints.

Calculating After-Tax Income from 35 an Hour

So, what does that mean for your take-home pay? Well, let’s break it down. Let’s say you make that $72,800 a year. After accounting for federal taxes, you’re looking at around $58,000 that you actually get to keep—give or take a few bucks depending on deductions.

Don't forget about state taxes and Social Security contributions. These can vary greatly depending on where you live—some states have state income tax while others, like Texas or Florida, don’t. It’s crucial to factor those in too… just like adding salt to a recipe—you really can’t skip it, or it’ll taste off!

Implications for Income and Budgeting

Now that we've navigated through the tax landscape, what does all this mean for budgeting? Well, earning 35 an hour is an excellent starting point, but after taxes, it's wise to know what’s left in the pot. You might want to set aside money for savings, bills, unexpected expenses, and, of course, some fun—because life’s too short not to enjoy a night out or a weekend trip.

Think about it: with your after-tax income, you might want to create a budget that reflects your priorities. Maybe you’re saving for a new car, moving out, or planning a vacation—whatever it is, you'll need to manage your money wisely.

One personal tip? Always try to have a little cushion—call it your “rainy day fund.” It helps to ease worries when unexpected expenses pop up, like car repairs or medical bills. That way, you’re not scrambling when life throws you a curveball.

So, there you have it! Figuring out how much 35 an hour is how much a year involves more than simple math; it includes understanding how tax brackets work and how they impact your take-home pay. Embrace the journey, and don’t be afraid to reach out if you have questions. After all, it’s your hard-earned money—make the most out of it!

Employment Trends and Future Outlook

When you break it down, earning $35 an hour adds up to quite a chunk of change over the year. You’re looking at about $72,800 if you work full-time. That’s decent money—but what’s the scoop on jobs that pay around this wage? Well, let’s dive into the trends.

Analysis of Employment Trends Related to $35 Hourly Wage

Jobs that pay $35 an hour are popping up in various sectors. You’ll find them mostly in healthcare, IT, skilled trades, and some roles in education. These jobs often require specialized skills or education, which ramps up competition. So, if you’re eyeing that kind of wage, make sure you’re equipped with the right skills.

Lately, we’ve seen a shift towards remote work. This trend lets folks snag positions not just in their hometowns but nationwide. It opens the door to more opportunities that might meet that hourly rate. However, remember: with more folks working from home, the race for those jobs can be fierce. You gotta stand out!

Future Job Market Predictions and Economic Adjustments

Looking ahead, the job market seems to be evolving. Experts predict certain sectors will keep growing. Healthcare is one of those, especially with an aging population. Tech jobs are also booming—they’re not going anywhere soon.

But, lest we forget, the economy can be a bit like a game of dice. Changes in policy, shifts in global markets, all that jazz can impact wages. Keeping an eye on these trends is crucial. The gig economy is growing too; freelancers might have the chance to charge higher rates in the future, which can be enticing.

Strategies for Staying Competitive in Evolving Job Markets

Staying competitive is key to nabbing that $35-an-hour gig. Here are some tips that might help:

-

Enhance your skills : Ongoing education is vital. Look for certifications or classes in your chosen field. It’s often a good idea to pick up tech skills—being tech-savvy can set you apart.

-

Network like a pro : Attend job fairs and connect with others in your industry. Talk to folks in your community. You never know who might have the inside scoop on a job that pays well.

-

Stay adaptable : Be open to learning new things. Today's in-demand skills might not be the same tomorrow. If something seems to be gaining traction, dive in.

-

Showcase your experience : Tailor your resume to highlight relevant skills. Use quantifiable achievements—numbers catch attention.

-

Consider side hustles : If you can juggle another gig, go for it. Freelancing or starting a small business can bring in extra cash and boost your experience.

In a nutshell, knowing how much $35 an hour translates to each year is just the beginning. Keeping an eye on job trends and adjusting your strategy accordingly is how you’ll stay in the game. Keep learning, keep networking, and you just might secure that job that pays you what you’re worth.

Previous article: Understanding Your 22 Hour Wage in 2025

Next article: How Much is 23 an Hour Annually in 2025

How Much is 35 an Hour Salary Annually in 2025: Share, Rating and Comments

0.0 / 5

0 Review