How Much is 23 an Hour Annually? Calculate Your Salary in 2025

Discover how to calculate your annual salary from 23 an hour in 2025, including tax impacts and cost of living considerations.

Understanding Hourly and Salary Wages

Let’s dive into the world of wages. A lot of folks get a bit tangled up when talking about hourly wages and annual salaries. So, what’s the scoop?

First off, an hourly wage is pretty straightforward. It’s the amount of money you earn for each hour of work. If you’re making 23 an hour, you get paid 23 bucks for every hour you clock in. Simple, right? Now, the annual salary is a bit different. This is a yearly sum—your total paycheck for the entire year. Trust me, it’s handy to know how to do the math to see how that hourly rate stacks up over time.

Now, here’s the kicker: many people think that hourly workers are always worse off than salaried folks. That’s a common misconception. Sure, some salary jobs might seem cushy—like the boss sitting behind a desk with a fancy coffee. But hourly jobs can have their perks too, like overtime pay. If you put in extra hours, ka-ching! That time adds up. Plus, if you’re not salaried, you might have more flexibility in your schedule. Who wouldn’t want to lead a more relaxed life?

Understanding these wage structures is super important for anyone looking to budget wisely. Knowing that 23 an hour is how much a year—$47,840, by the way—helps you figure out if that job is gonna pay your bills and maybe buy you a little fun on the side.

Think about it: if you don’t grasp how your earnings stack up, you might miss out on opportunities. You could be in a position to negotiate your pay or even decide if you need to pick up extra shifts or find a side gig. I learned this the hard way when I kept saying yes to work without ever checking how it affected my budget.

So, here’s my tip—get comfy with your paycheck structure. Whether it’s hourly or salary, both have their ups and downs. Just knowing your numbers puts you one step closer to financial freedom. And hey, wouldn’t that be a grand way to live?

Calculating Your Annual Salary from Hourly Pay

Alright, let’s dive into the nitty-gritty of how to figure out what "23 an hour is how much a year." It’s pretty straightforward, but a dash of math can feel like a chore. Don't worry; I've got your back!

How to Calculate Annual Salary Based on 23 an Hour

To calculate your annual salary from an hourly wage, you first need to know how many hours you work in a week. Most folks land around 40 hours if they’re working full-time. The math is simple: multiply your hourly pay by the number of hours you work per week and then by the number of weeks you work in a year. So, for 23 dollars an hour:

- Hourly Rate: $23

- Weekly Hours: 40

- Weeks in a Year: 52

Now, let’s do the math:

23 (hourly rate) × 40 (weekly hours) = 920 (weekly pay)

920 × 52 (weeks in a year) = 47,840

So, if you work 40 hours a week, you’d make $47,840 a year. Easy as pie, right?

Sample Calculations for 40 Hours a Week and Variations for Part-Time Work

Alright, now what if you’re working part-time? Say you work only 20 hours a week. The same idea applies:

- Hourly Rate: $23

- Weekly Hours: 20

The calculation goes like this:

23 × 20 = 460 (weekly pay)

460 × 52 = 23,920

That means, if you work half the hours, your annual pay would be $23,920.

But maybe you’re not bound by the typical 40-hour workweek. Let’s sprinkle in some variation. If you work 30 hours a week, here’s how it looks:

23 × 30 = 690 (weekly pay)

690 × 52 = 35,880

So, if you're clocking in 30 hours weekly, you'd rack up $35,880 a year. It's nifty to see how part-time work can still yield a decent annual salary.

Tools and Resources for Accurate Salary Calculations

If math isn’t your strong suit, don’t sweat it. There are plenty of handy online calculators out there. Just type in “annual salary calculator” in your favorite search engine, and voila! You’ll find tools that allow you to play with numbers. Just remember that these calculators often start with the basic formulas we talked about.

Another great tip? Microsoft Excel can be your best buddy here. You can set up a simple formula to calculate your salary for different hours. Set it and forget it!

And hey, if you’re feeling adventurous, there are apps particularly designed for this. They make it so easy—just input your hours and hourly rate, and boom—instant salary breakdown.

So there you have it! Calculating how much 23 an hour is how much a year isn’t rocket science. Just a bit of math, some nifty tools, and you’re set. Plus, it’s a neat skill to have in your back pocket.

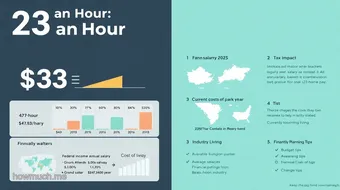

The Impact of Taxes on Your Earnings

So, you’re earning 23 an hour and curious about how that stacks up when tax season rolls around. Let’s break down what this really means and how taxes can take a bite out of your paycheck.

Overview of Federal Income Tax Brackets in 2025

In 2025, the federal income tax brackets are structured like this:

- 10% on the first $11,000

- 12% on income from $11,001 to $44,725

- 22% from $44,726 to $95,375

As you can see, these brackets mean that the more you earn, the higher percentage you'll end up paying on that extra income. It's like climbing a steep hill; each level contains a bit more effort.

Now, at 23 an hour, you’re likely working around 40 hours a week—if we do some quick math, you’re pulling in about $48,000 a year before any taxes kick in.

How Taxes Affect Your Take-Home Pay at 23 an Hour

So, what does that mean for your take-home pay? When you break it down, after taxes, you may see around 70-75% of that amount remaining. So, not wanting to rain on your parade, but you might end up with around $35,000 to $36,000 to work with yearly.

That’s the reality check. You start with a nice number, but after taxes, it can feel kind of like when you open a box of chocolates—all excited, only to find many are just plain dark chocolate… where’s the nutty caramel goodness?

Strategies for Minimizing Tax Liabilities

Now that we’ve got your head spinning with numbers, let’s switch gears. Here are some practical tips to keep more of your hard-earned cash:

-

Contribute to a 401(k) : If your job offers this, definitely consider it. Not only does it lower your taxable income, but it also sets you up for future riches—like finding a treasure chest buried in your backyard.

-

Take Advantage of Deductions : Keep an eye out for things you can deduct, like student loan interest or certain work-related expenses. It’s like finding spare change in your couch cushions.

-

File Early : Get your taxes done early! It gives you more time to spot mistakes and possibly discover deductions that could help you.

-

Consult a Tax Professional : They can help you navigate the tricky waters of your taxes. Think of them as your trusty guide through the wild forest of tax codes.

Understanding how taxes affect your earnings is crucial. So when you sit down to consider how “23 an hour is how much a year,” remember: it’s not just about that magical number. Your take-home after taxes is what really matters. Tame those beasts of tax liabilities, and you’ll have more to stash away for that big trip or whatever your heart desires.

Cost of Living Considerations in 2025

So you’re crunching the numbers and wondering, “23 an hour is how much a year?” Well, let’s break this down while also tackling the eye-watering cost of living out there as we head into 2025.

Current Cost of Living Factors in Major Cities

First off, cost of living is a biggie—especially in major cities. Think about New York City versus, say, Omaha. In NYC, the rent can shoot through the roof! A one-bedroom apartment could cost upwards of $3,000 a month. Meanwhile, in Omaha, you might pay around $1,200. With all those extra pennies flying around, that’s a hefty consideration.

Other factors? Groceries, transportation, dining out. A simple dinner in Manhattan could easily wipe out a full day’s earnings if you're not careful. It’s crucial to consider these day-to-day expenses when you’re gauging what your earnings mean for your wallet.

Comparing Salaries Across Different States or Cities

Now, let’s look at how the $23 an hour stacks up across different states. In California, for example, that amount isn't going to cut it nearly as well as in, say, Texas. You might find yourself living in a shoebox if you’re in a hot-spot like San Francisco, where everything costs twice as much as it does in Austin.

So, if you're making $23 an hour—great! But take a minute to check the local averages. Some cities might pay more, but with that pay come higher living costs. Honestly, it can feel rather like a never-ending treadmill—running to keep up but going nowhere.

How Inflation Impacts Annual Income Calculations

Now, about inflation—if you’re feeling the pinch, you’re not alone. That steady rise in prices means your pay doesn’t stretch like it used to. If you’re earning $23 an hour, that's about $47,840 a year before taxes. But with inflation, you might find that what once covered your groceries and gas is starting to feel more like just enough to buy a few loaves of bread.

Also, keep in mind that inflation can shift faster than the weather in Britain. What feels like a comfy wage today might not be so cozy a year or two down the line. It’s that pesky toll on your buying power that sneaks up when you're not paying attention.

So, how do you handle all this? Stay informed. Budget wisely. When you're thinking about how much is $23 an hour yearly, don’t forget to factor in where you live, what it costs, and that little thing called inflation. It pays to think ahead. Honestly, juggling numbers can be overwhelming; I learned the hard way. So keep your eyes peeled, and best of luck navigating the changes ahead!

Salary Comparisons Across Different Industries

When you think about earning 23 an hour, it's natural to wonder just how that stacks up in different fields. Let's break that down together. If you're putting in a standard 40-hour workweek, that amounts to roughly $47,840 a year — pretty decent, right? But not all jobs are created equal.

Average Salaries for Similar Job Roles Paying $23 an Hour

In some industries, making 23 an hour is quite common. For instance, many administrative roles offer similar pay. You might find that roles like project coordinators or medical assistants fit this paycheck bracket. In the retail sector, certain supervisory positions might land right around this figure too. It’s interesting how similar tasks can have such different pay based on where you work.

But then, take a look at tech jobs. Entry-level positions in tech, like help desk support, often start higher than that. It seems like every company is scrambling for skilled techies, huh? So, while 23 an hour is how much a year can vary, you might see those numbers jump quickly in high-demand areas.

Industry-Specific Financial Growth and Opportunities

Now, let’s talk growth. Some industries are ripe for progress. For instance, healthcare and tech are growing faster than a weed in a summer garden. If you land a job in these sectors, you might find your paycheck growing exponentially over the years.

On the flip side, certain fields, like retail or hospitality, might struggle to keep pace. Promotions and raises can feel like pulling teeth sometimes — slow and painful. If your heart's set on one of those path, be sure to scout growth opportunities within the company. It’s all about positioning yourself right. Sometimes, you might just need to be in the right place at the right time.

How to Negotiate Your Salary Based on Industry Standards

Okay, let’s get down to the nitty-gritty: negotiating your salary. First off, know what you’re worth! Research average salaries in your area for your role. Websites like Glassdoor and PayScale can be pretty handy.

When talking to your boss or a potential employer, bring your research. Say something like, “I’ve noticed that similar positions offer a bit more,” followed by your data. Keep it friendly, but firm. You don’t want to be wading in waters too deep for your skills.

Don’t forget to highlight your strengths and what you bring to the table. After all, if you’re adding value, you deserve a slice of the pie! And if you feel brave, don’t hesitate to ask, “Is there room for negotiation?” Sometimes employers have more wiggle room than they let on.

As a tip I learned from my own experience, approach salary talks like a dance, not a showdown. Keep it light and upbeat, but don’t let them walk all over you either. Trust me, it pays to be prepared.

In summary, understanding salary comparisons across industries can help you see how far your hard work can take you. Whether you're negotiating or looking for growth potential, do your homework. Making 23 an hour is how much a year matters not just today, but for your future. Stay savvy, and you’ll do just fine!

Tips for Financial Planning Based on Your Salary

So, you've landed a gig that pays $23 an hour—great! But now you might be wondering, "23 an hour is how much a year?" Well, after some good old math, that adds up to about $47,840 annually—provided you work a steady 40-hour week. Now, let's roll up our sleeves and talk about how to best manage that income.

Budgeting efficiently on an Annual Income of $23 an Hour

First things first: budgeting. It's like setting the table for a feast; without it, you'll probably end up with a mess. Start by breaking down your monthly expenses. Think rent, groceries, utilities, and a bit of fun money. A classic approach is the 50/30/20 rule. Here’s the breakdown:

- 50% for needs: This is the bread-and-butter stuff—housing, food, transport.

- 30% for wants: Treat yourself—be it a cinema night or a fancy coffee.

- 20% for savings or debt repayment: This part is like putting aside grain for the winter.

You’ll thank your foresight later! And if you find yourself struggling, don’t hesitate to revisit your budget every month. Real life is full of surprises... like that time I thought I’d spend less on takeout but ended up in a taco frenzy!

Setting Financial Goals with Your Yearly Earnings

Next up: setting some financial goals. Goals are like the North Star for sailors—they guide your journey. With your income of $47,840, think about what you want in the short and long term.

- Short-term goals: Maybe you want to build an emergency fund for those “oh no!” moments. A good target could be somewhere around three to six months of expenses.

- Long-term goals: Perhaps home ownership or retirement is on your radar. Ideally, start a separate savings account for these dreams and chip away at them bit by bit.

Get creative: set up a vision board, or jot things down in a journal. Keep dreaming big but stay grounded, too—baby steps, right?

Resources for Financial Planning and Investment Strategies

Now, let’s chat about resources. There’s plenty out there to help you on your financial journey. You don’t have to do it alone!

- Budgeting apps: Consider using Mint or YNAB (You Need A Budget). They can help you track every dollar. You’ll be shocked to see where it’s all going!

- Books: “The Total Money Makeover” by Dave Ramsey is often a crowd favorite. His advice is clear and downright practical.

- Online courses: Websites like Coursera or Khan Academy offer classes on financial literacy. Knowledge is power, mate!

And speaking of power, don’t forget about investing. Even with a modest income, you can start small—maybe look into index funds or consider a retirement account like a 401(k) with your employer. You might even find you have a knack for it—better to let your money work for you instead of the other way around!

In the end, it’s all about taking it step by step. Financial planning can seem daunting, but with your new hourly wage, just remember: you're the pilot of your own ship. Stay the course, keep learning, and you'll find your path to financial freedom... and maybe even a bit of comfort down the line.

Frequently Asked Questions

Alright, let’s dig into the nitty-gritty of what it means when someone says, "23 an hour is how much a year?" It sounds a bit like a puzzle, doesn’t it? So, let’s untangle that.

What is 23 an hour is how much a year?

If you’re raking in 23 bucks every hour, you’ll want to know the big picture. To find out how much that adds up to in a year, you need to consider how many hours you work. Let’s say you work full-time, about 40 hours a week. So, here’s the math:

23 dollars x 40 hours x 52 weeks = 47,840 dollars a year. That’s right! Stick 47,840 in your pocket if you’re clocking in those hours! Easy peasy, huh?

How do I calculate my yearly salary from an hourly wage?

Calculating your yearly salary is straightforward. First, take your hourly wage. Next, multiply it by the number of hours you work each week. Then, multiply that number by 52 since there are 52 weeks in a year. For example, if your hourly wage is 23, just use the formula:

Hourly wage x Hours per week x Weeks in year = Yearly salary. Just plug in the numbers, and boom, you've got your annual earnings!

Is 23 an hour a good salary in 2025?

Now, this is a bit of a tricky one. Prices and living expenses vary from place to place. In 2025, if inflation keeps creeping along, 23 bucks an hour might feel different. In some areas, it might just cover the basics. But in others, it could help you live comfortably. So, think about where you live and what your expenses look like. It’s all relative, you know?

What factors can affect my annual income at 23 an hour?

Your annual income isn't just about the hourly wage; other things come into play. If you work overtime, that can boost your income. Plus, changes in job demand can affect how many hours you can snag. Your industry also plays a role. Some fields pay more than others for similar work. Lastly, benefits and perks can sweeten the pot too—healthcare, bonuses, and retirement plans are all part of the package.

So, when considering your earnings, think about all these pieces. Knowing "23 an hour is how much a year" is just the beginning! Keep your eyes peeled for opportunities to bump that number up. You never know when a new chance might come knocking—so keep hustling!

Previous article: How Much is 35 an Hour Salary Annually

Next article: Calculate Annual Salary from Hourly Wage

How Much is 23 an Hour Annually? Calculate Your Salary in 2025: Share, Rating and Comments

0.0 / 5

0 Review