Calculating Your Earnings: $24 An Hour Equals How Much A Year?

Discover how much $24 an hour translates to yearly earnings and explore financial planning strategies for your career.

Introduction

Have you ever wondered how much you can earn in a year with an hourly wage of $24? It's like asking yourself how many pints you can drink at the local pub before the sun sets. The answer is crucial, especially if you're trying to figure out budgets, savings, or even just planning your next big adventure.

Many folks find themselves scratching their heads when it comes to understanding their potential earnings based on their hourly wages. You’re not alone if you've ever felt lost in a sea of numbers. You might be thinking, "How far can $24 an hour stretched over the course of a year?" It can get tricky when you throw in work hours, taxes, and other variables. Trust me, I’ve been there, trying to make sense of it all amidst the chaos of life.

But don’t fret! In this article, we're diving deep into the numbers, untangling the calculations, and making sense of what it means to earn $24 an hour. We'll break down the earnings month by month, compare it to the yearly averages, and give you some insights into how this impacts your financial planning. You’ll walk away not only knowing exactly how much $24 an hour is how much a year, but also feeling empowered to take charge of your financial future. So grab a cuppa and let’s get into it…

How To Calculate Your Salary: A Simple Formula

So, you want to know how much $24 an hour is how much a year? Let’s break it down in a way that makes sense. It’s easier than you might think.

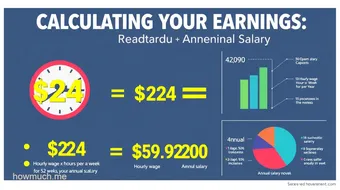

The Formula for Conversion from Hourly Wage to Annual Salary

Here’s the simple formula you'll need:

Annual Salary = Hourly Wage × Hours Per Week × Weeks Per Year

You might be wondering, "How do I know those numbers?" Well, the typical full-time gig runs about 40 hours a week, and most folks work about 50 weeks a year. Sure, you may take vacations, but that’s a fair estimate.

Detailed Breakdown of Hours Worked per Week and Weeks Worked per Year

To keep things straightforward, let’s assume you're working 40 hours each week — that's the classic 9-to-5, Monday to Friday routine. If you're in the U.K. or somewhere else across the pond, you might call it “working a full fortnight.” Now, let's say you work for 50 weeks. That gives you two weeks off each year — hopefully for a relaxing holiday or a cheeky trip.

Example Calculations Using $24 per Hour

Alright, let’s plug those numbers into our formula.

- Start with your hourly wage: $24.

- Multiply that by 40 hours a week:

24 × 40 = 960. That’s $960 a week. - Now multiply that by the 50 weeks you work:

960 × 50 = 48,000.

So, if you’re earning $24 an hour and working 40 hours a week for 50 weeks, your annual salary would be $48,000 a year.

So, there you have it! $24 an hour is how much a year? Well, it’s $48,000. Easy as pie, right? Just remember to adjust for your own working hours if you’re doing things differently, like working part-time or picking up some overtime. Those extra hours can make a real difference!

So, do you feel a little more confident about calculating your salary now? Happy budgeting!

The Importance of Understanding Your Hourly Rate

When you hear someone say "$24 an hour is how much a year," it's not just numbers tossed around. It's a big deal when you think about budgeting and planning for the future. Knowing your hourly wage helps you figure out how to meet those pesky monthly bills like rent, groceries, and maybe even a few leisurely pints at the local pub.

Wage Comparison and Financial Planning

Let's break it down. If you work 40 hours a week, $24 an hour adds up to about $50,000 a year. That’s decent money. But what does that really mean in today’s world? When you compare it to other wages, you start to see the broader picture—like how it stacks up against minimum wage, which often hovers around the $7 to $15 range, depending on where you live. Understanding these differences lets you know if you’re making enough to thrive instead of just survive.

Minimum Wage vs. Living Wage Dynamics

Now, here’s where things get tricky. Minimum wage is like the base level, the floor we can sink to. But living wage? That's the amount you actually need to live decently without cutting corners. A good rule of thumb? The living wage may be closer to $16 or $17 an hour in many areas, meaning $24 is actually a step above that notch on the ladder. It’s crucial to know this stuff. It helps in making informed choices—whether to take that job offer or to negotiate for better pay.

Hourly Rates and Overall Compensation

Now let’s chat about what $24 an hour means for your total compensation. It’s not just about the cold hard cash in your pocket. Hourly rates often come along with benefits like health insurance, retirement plans, and paid time off. Think about it—if a job pays you less per hour but offers a solid benefits package, it might turn out to be a better deal. You can’t forget those full benefits when calculating what you'll take home.

Keeping your eye on your hourly rate helps you navigate the financial maze of adulthood, making sure you’re not just scraping by. And remember, it’s always smart to advocate for yourself. If you’re worth $24 an hour, don’t be shy about asking for it.

So next time you ask, “$24 an hour is how much a year?” remember—knowing the answer isn’t just trivia. It’s about securing your place in life. Sure beats living paycheck to paycheck, doesn’t it?

Factors Influencing Salary and Compensation

When you think about how much someone makes, there’s a lot more at play than just the number on the paycheck. Ever wonder why one job pays more than another? Well, let’s explore the real reasons behind it.

Overview of Employment Compensation Across Different Sectors

First off, let’s take a gander at the different sectors out there. What folks earn can really vary. For instance, jobs in healthcare often pay more than those in retail. A nurse can pull in some serious dough, while a cashier might just skim by. It’s all about what industry you find yourself in. Think about it: certain fields like tech and finance tend to offer fatter paychecks, since they’re often tied to higher skill levels or demand.

And then there’s the gig economy. That whole “I’ll drive for Uber” thing? It can be hit or miss. Some drivers might see a fair wage, while others might struggle. It’s a mixed bag, really.

Role of Experience and Education in Salary Determination

Now, experience and education—those are game-changers. Ever notice how job postings often say “5 years of experience required”? That’s because the longer you’ve been in the workforce, the more skills you pick up. It’s kind of like leveling up in a video game: the more you face challenges, the better you get at tackling them.

Having a degree—especially in a field like engineering or nursing—can seriously boost your salary. It shows employers you have a solid foundation of knowledge. But here’s a tip: don’t think a degree is the only route. Some trades pay very well without requiring a fancy diploma. Sometimes, hands-on training can set you up for a decent paycheck.

Geographic Differences in Wages and the Cost of Living

Next up, let’s chat about geography. Ever heard someone say “location, location, location”? That phrase rings true in the salary world. Take, for example, living in New York City versus a small town in Iowa. You might earn the same wage, but the cost of living is worlds apart. Rent in NYC will chew through your budget quicker than you can say “expensive coffee”.

So, if you’re calculating how much $24 an hour is how much a year, remember that it gestures toward a certain standard of living depending on where you set up shop. In some areas, that amount could let you live comfortably; in others, you might be scraping the barrel. Always consider the local cost of living when thinking about salary. A pretty penny in one place might not get you far in another.

And let’s be honest, it can all be a bit confusing. Sometimes, knowing how to balance your income with where you live is a real juggling act. If you’re eyed at making a move, do your homework. Places with high wages often come with high costs.

Ultimately, your salary is a puzzle made up of various factors. By understanding how these pieces fit together, you'll have a better grasp on what you’re worth in the bigger picture. So, whether you’re making $24 an hour or dreaming of a raise, keep these factors in mind. They could be the key to unlocking more than just your paycheck.

Comparison of Hourly Pay Across Different Industries

When we talk about money — especially how much you can make in a year at $24 an hour — it really gets interesting when you dive into how different industries stack up. So, let’s break it down.

Analysis of Average Salary by Industry for $24 an Hour

So if you’re clocking in at $24 an hour, that adds up to about $49,920 a year, assuming you’re working a standard 40-hour week for all 52 weeks. Now, how does that sit in different fields? Well, certain industries are known for paying better than others.

In the healthcare field, for instance, roles like a registered nurse or a radiologic technician can often hit that mark or even higher. Now, if we peek into the construction sector, skilled trades like electricians or carpenters may also offer comparable pay. On the other hand, entry-level positions in retail or food service typically linger around minimum wage, which can be quite a jump down from our $24 an hour sweet spot.

Examples of Professions That Typically Pay $24 Per Hour

Alright, let’s get our hands dirty. There are some solid jobs out there where $24 an hour is a common rate. Picture this: you might find paralegals, dental hygienists, or even marketing specialists pulling in that kind of dough. These jobs not only pay well but can also offer solid benefits.

Hmm, let’s not forget about tech jobs! If you’re into IT, positions like help desk support or some entry-level coding gigs can hit that mark as well. It’s kind of cool to see how diverse the options are if you’re aiming for that hourly pay.

Trends in Labor Market Rates and Employment Compensation

Now, let’s chat about the big picture — the economy and jobs. The labor market is always shifting. In recent times, many employers have started paying more. This is partly due to a tight labor market where workers have more power. So, if you’ve been considering switching jobs or leveling up your skills, now might be the time.

Oh, and with remote work becoming common, some positions that might’ve seemed out of reach before are now accessible from your couch. You’d be surprised at the variety of jobs paying $24 an hour being offered online!

Remember, keeping an eye on local job markets is key. What’s hot in New York might differ from what’s trending in Nashville. So, do your research!

So there you have it! Whether you're considering a career switch or just curious, knowing where $24 an hour sits across different industries can help guide your next steps. Keep your options open, and don’t be afraid to reach for that next rung on the professional ladder.

Maximizing Your Earnings: Tips and Strategies

Alright, let’s dive into how to truly make the most out of earning $24 an hour. Sounds like a pretty decent wage, right? So, just how much is that for a year? Well, if you crunch the numbers, it amounts to around $49,920 annually, assuming a full-time gig at about 40 hours a week. Now, let’s explore how you can maximize this income and perhaps even boost it.

Salary Negotiation Tips for Professionals Seeking $24 an Hour Jobs

First off, if you’re hunting for a job that pays $24 an hour, don’t sell yourself short. Seriously. Know your value. When you sit down for that interview, think of it as haggling at a local market. Speak up about your skills and experience — and be bold. According to market research, jobs in fields like healthcare, tech, and trades pay well and often have room for negotiation.

Don’t shy away from asking for what you want. But hey, do your homework. Research what others in your field are earning. You can use tools like Glassdoor or PayScale. Trust me, showing up armed with facts makes you look prepared... and a bit fearless! And if they counteroffer, don’t jump at the first number. Take a beat, maybe even sleep on it. It’s all about that chess player mindset.

Financial Planning Strategies to Manage Income efficiently

So, you’ve landed that $24-an-hour gig — brilliant! Now, let’s talk about keeping more of it in your pocket. A solid financial plan is key. Start by crafting a budget. You know, the classic "spend less than you make" principle. Track your expenses — it’ll open your eyes. Believe me, I once thought my coffee habit was harmless. Spoiler alert: it wasn’t.

Put some cash aside for savings. Aim for at least 20% of your income, if you can swing it. It's like having a safety net — a warm fuzzy feeling when life throws curveballs. Oh, and don’t forget about the ol’ 401(k) if your job offers one. It’s free money, folks!

Consider diversifying your investments as well. Maybe dabbling in a side hustle? A little extra work can help bolster your cash flow. Use skills you’ve got — be it graphic design, writing, or even fixing up bikes!

Insights on Scaling Up Earnings Through Skill Development and Certifications

Ready to take your earnings up a notch? Let’s get you some shiny new skills. Think about what’s in demand. Fields such as IT and healthcare often look for specific certifications. Ever heard of CompTIA or PMP? They add some serious cred to your resume. I didn’t realize the value of these until a colleague nabbed a high-paying job after getting certified. Talk about a wake-up call!

Consider online courses. Many platforms, like Coursera or Udemy, offer affordable options. Slap a few on your résumé, and you’ll look unstoppable. Plus, these skills can help snag those dream positions that pay way more than $24.

So there you have it! Keep these tips in mind as you navigate the intriguing landscape of earning $24 an hour. With a little negotiation charm, smart financial planning, and ongoing learning, you can stretch your earnings and even redefine what that hourly rate means for your future.

Frequently Asked Questions

Let’s dive right in. You might be wondering, “$24 an hour is how much a year?” Well, if you clock in 40 hours a week, that shakes out to about $49,920 a year. Not too shabby, right? However, if you work part-time or earn overtime, the numbers can play around a bit.

Now, let's chat about whether $24 an hour is considered a good salary. Honestly, it depends. In many areas, that number can cover your bills comfortably, while in pricier cities, like London or New York, it might feel a bit tight. One person's "living the dream" is another's "scraping by." It’s all about perspective and where you hang your hat.

So, how do you calculate yearly salary from an hourly wage? It’s pretty straightforward. You simply multiply your hourly wage by the number of hours you work in a week, then multiply that by the number of weeks in a year. Easy peasy! For example, taking that $24 an hour, it’d be $24 × 40 hours × 52 weeks. Crunch those numbers, and you get that nearly $50K!

On to the nitty-gritty. What are the differences between hourly and salaried jobs? Hourly workers get paid for every hour they work, while salaried folks earn a fixed amount no matter how many hours they clock in. The key difference? Hourly workers might get overtime pay for extra hours worked — more cash in hand if they put in the extra effort. In contrast, salaried positions usually expect you to stick around longer without extra coin. It’s like being knighted versus being a humble villager... both have their perks!

Now, onto a topic no one really likes but we all have to think about: taxes. How does an hourly wage impact tax liabilities? Well, it’s pretty simple. When you earn an hourly wage, you’re taxed based on your earnings. So if you make $24 an hour, Uncle Sam’s gonna want his share. The more you earn, the higher your tax bracket, but don’t worry too much — there are deductions and credits that can ease the sting a bit.

There you have it! You’re now armed with the knowledge to understand what $24 an hour really means. Knowing how to break it down can help you navigate job offers like a pro. So next time you hear that hourly wage, you won’t be scratching your head!

Previous article: $28 an Hour to Yearly Income Explained

Next article: All You Need to Know About Smith Machine Bars

Calculating Your Earnings: $24 An Hour Equals How Much A Year?: Share, Rating and Comments

0.0 / 5

0 Review